Budget Your MD Newsletter: Issue 2.0

Elon Musk didn’t just settle for a regular car, he reinvented the entire industry with Tesla. And while you’re not launching a rocket or building electric cars, you’re about to do something equally revolutionary: avoid all the classic financial pitfalls and scoop up all the free stuff the banks are eager to hand out. Think of it as your chance to upgrade your financial game without getting trapped by gimmicks. Just like Musk doesn’t settle for “good enough,” you’re here to pick the best bank deals that will put cash, perks, and rewards in your pocket, so you can cruise through med school with a little extra in the bank.

In today’s email:

Who’s the prettiest of them all? 💁♀️ A breakdown of which banks offer the best deals for medical students.

The real value 👀 In depth analysis of the most popular offers.

Behind the curtain 🙄 A closer look at why banks are so keen to woo medical students.

👇 TRY IT NOW: Create scenarios to see how much student debt is manageable based on your specialty, lifestyle, and family plans. Plan smarter with just a click!

THE BIG IDEA

Who’s the prettiest of them all? 💁♀️

As many of you know, we’re offered massive lines of credit when we finally receive that sought after acceptance letter to medical school. Suddenly, the banks are interested in us. How nice? But also interesting… Why do you want the business of a young adult with essentially zero income? Well. We all know the answer right? It’s all about what’s coming down the pipe. We’re excited for it and so are they. Today’s post is all about managing that unique relationship between us and the big bank. Strap in. This stuff is either super exciting or utterly boring, it’s your choice to make. The unfortunate part? There is no hiding from it.

Let’s tackle things from the onset… You’ve been accepted into medical school and it’s time to choose a bank. Most people continue to use their current bank, usually set up for them by their parents. We’re adults now, it’s time to make your own choices! This also comes with some big time benefits. I’m going to break to down bank by bank soon but here are a few general points.

First date appeal: Banks love poaching clients from other banks. Using this to your advantage can give you some extra spending cash. Look for “new account activation” offers which can range up for $600 cash if you’re new to a bank.

Got it? Flaunt it. Make sure you let them know you’re a medical student, soon(ish) to be doctor. This will unlock free accounts, free credit cards and hopefully better service.

Generate competition: If you notice another bank offers something your bank doesn’t. Tell them about it. Mention that you’re considering moving banks. This can sometimes incentive them to pull some string for you to stick around. Particularly helpful if you want to stay at your current bank.

The real value 👀

When I started medical school in 2020, choosing the right bank was a critical decision. After weighing my options, I picked Scotiabank, and here’s why it stood out:

1️⃣ Credit Card Perks That Stack Up

Scotiabank’s American Express offers an unbeatable 5 points per dollar on groceries, dining, and subscriptions. Sure, not every store takes AMEX, but here’s the kicker: Scotiabank lets you pair it with a Visa, ensuring you’re covered everywhere. Plus, they’re the only bank (from what I’ve seen!) that lets you hold multiple credit cards, doubling your chances to cash in on welcome rewards.

2️⃣ Physician-Focused Services

In 2019, MD Management—a financial advisory firm dedicated to doctors—merged with Scotiabank. To me, this signaled their long-term commitment to understanding and supporting physicians’ financial needs.

💡 Pro Tip: Thinking of switching banks for a chequing account welcome bonus? That perk is usually reserved for first-time customers only. If you’ve already banked with them, it’s unlikely they’ll extend the same deal.

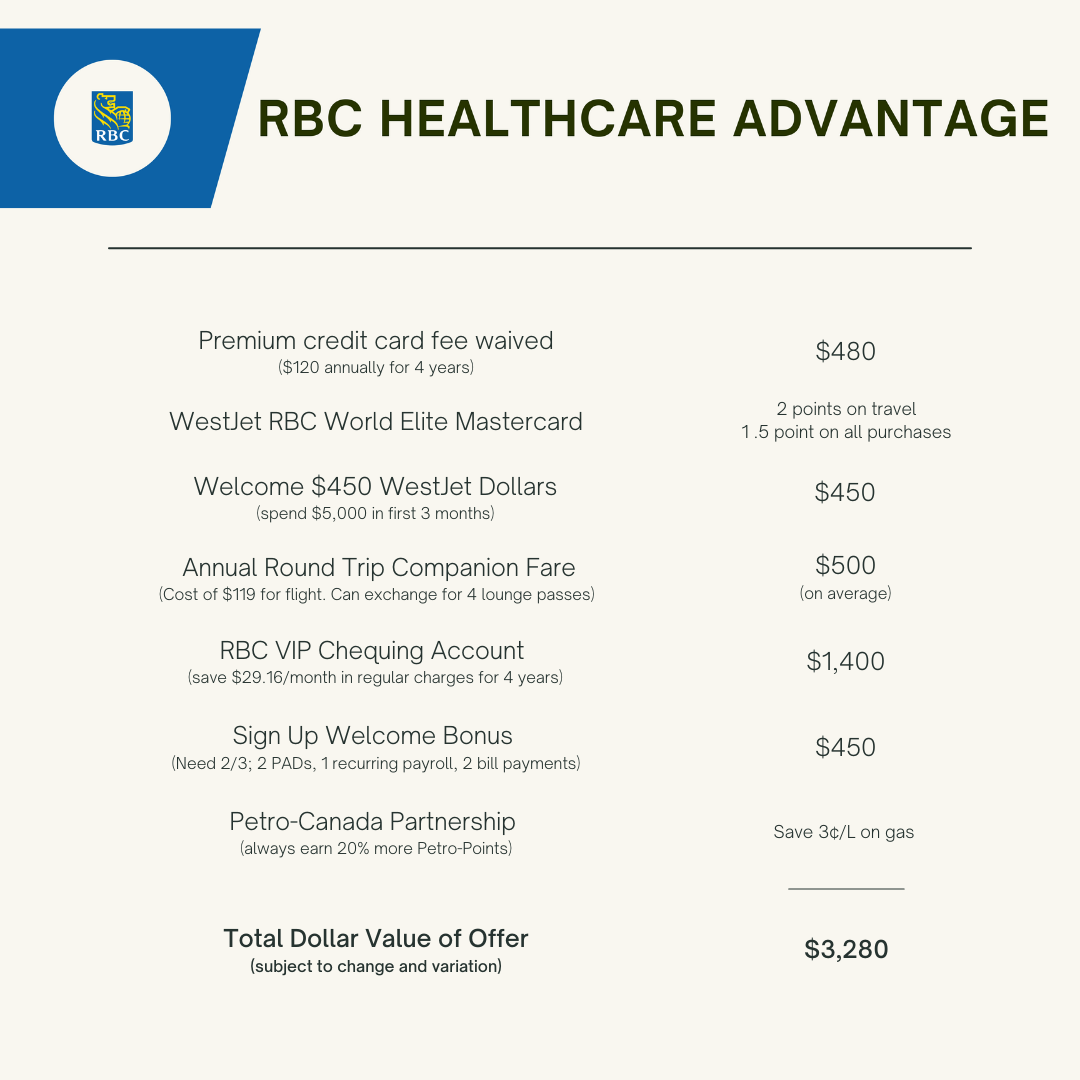

RBC is offering a solid and competitive package for medical students, and their focus on keeping students as customers throughout university is evident. It’s no surprise they’ve crafted a deal tailored to future medical professionals.

Here’s what stands out about their offer:

1️⃣ Petro-Canada Partnership

One unique feature of RBC’s offer is its partnership with Petro-Canada, giving students a chance to save a little on gas. However, when you crunch the numbers (using Canadian averages), the 3 cents per litre discount doesn’t amount to much in the grand scheme of things. While it’s a nice-to-have perk, it’s unlikely to make a big impact on your budget.

2️⃣ $450 Sign-Up Cash

A standout benefit is the $450 welcome bonus for new customers. If you haven’t previously banked with RBC, this is an excellent opportunity to offset the costs of your move or even help with purchasing a new computer for school. The cash bonus is flexible and can be used however you need—perfect for medical students looking to ease financial stress.

3️⃣ Credit Card Limitation

RBC offers a choice between the Avion Visa Platinum and the WestJet Mastercard, but you’ll only be able to choose one. The Avion Visa Platinum is great for travel and points, while the WestJet Mastercard offers an annual companion voucher. The catch? If you’re in medical school, chances are your travel schedule is pretty tight, and if you don’t use the companion voucher within a year, it expires.

💡Pro Tip: For those of you who frequent Costco like I do (I’m a huge fan!), the WestJet Mastercard is the better option since Costco only accepts Mastercard. I’ve got both the WestJet card and the Scotiabank cards, which allows me to maximize my points no matter the situation. More on this later!

CIBC offers a competitive medical student package with features that align with many other bank offers. It includes a $350,000 line of credit (LOC) and a premium credit card waiver for the 4 years of medical school, which provides some solid financial backing for the busy years ahead.

What you need to know about their offer:

1️⃣ Line of Credit & Premium Credit Card Waiver

CIBC offers one of the largest LOCs among Canadian banks, giving you significant flexibility and financial support as a medical student. Plus, the premium credit card is waived for all four years, which is a fantastic perk for students looking to avoid extra fees.

2️⃣ Credit Card Points Accumulation

However, where CIBC’s offer falls a bit short compared to others is in the credit card rewards. While they offer decent welcome bonuses, the everyday points accumulation is less rewarding. For example, you’ll only earn 1.5 points per dollar spent on groceries, whereas Scotiabank’s AMEX offers a much higher rate of 5 points per dollar for groceries. If maximizing rewards is a key factor for you, this could be a dealbreaker.

3️⃣ One Credit Card Choice

Another limitation with CIBC’s offer is that you’re only able to choose one credit card. While other banks like Scotiabank let you pair multiple cards for maximizing benefits, CIBC’s singular credit card option reduces your potential for earning significant bonus points or rewards. This could be important if you’re looking to build up rewards quickly or take advantage of multiple welcome bonuses.

When it comes to TD’s medical student offer, it doesn’t quite stack up to the benefits offered by Scotiabank, CIBC, or RBC. TD’s offer feels more general and less tailored to the unique needs of medical students, which may be why it lacks some of the standout features the other banks provide. However, there are a few things to consider if you’re looking at TD for your banking.

Key Features of TD’s Offer:

1️⃣ 5 Points on Travel with the Platinum Travel Visa

If you’re planning on travelling during medical school (although it’s not very common), TD offers 5 points per dollar spent on travel with their Platinum Travel Visa. While this is a good perk for those who will take advantage of it, medical school is typically busy, and many students may not have the time or flexibility to travel frequently.

2️⃣ 3 Points on Groceries

TD also offers 3 points per dollar on groceries, which is a decent rewards rate compared to some other options. This could add up if you’re consistently spending in this category, but it still doesn’t compare to Scotiabank’s AMEX, which offers a far higher reward rate for grocery purchases.

3️⃣ Limited Credit Card Options

Another downside of TD’s offer is that you’re only able to choose one credit card. While you have the option to select between two good cards—Platinum Travel Visa and TD Rewards Visa—you’re still stuck with only one, unlike other banks that let you maximize rewards by pairing two cards. You’ll need to carefully consider which one suits your lifestyle best.

When evaluating BMO’s medical student offer, it’s immediately clear that the total value of their deal is lower compared to other banks. One of the major drawbacks is the CashBack Mastercard. While this card does offer a no annual fee benefit, it’s not as rewarding or unique as the premium credit card offers from other banks, like Scotiabank or RBC. Typically, the annual fee on a credit card correlates with the benefits it provides, and BMO’s no-fee card feels a bit lacking in comparison.

Key Points to Know About BMO’s Offer:

1️⃣ CashBack Mastercard

The CashBack Mastercard from BMO has no annual fee and offers cashback rewards on purchases, but it doesn’t come close to the benefits offered by other premium cards. Without an annual fee, there are fewer perks—meaning less earning potential for students who want to maximize rewards.

2️⃣ Limited Line of Credit (LOC) Access

Another significant limitation is the LOC access. In the first year, you’ll only have access to $95,000 of the $350,000 LOC. This can be a downside if you need more financial flexibility during your first year of medical school. However, this may be BMO’s way of protecting you from risky financial behavior, like using the LOC for investments or large purchases before you’re ready to manage them effectively.

💡 Pro Tip: If you’re already banking with BMO and feel like you’re missing out, consider reaching out to RBC, CIBC, or Scotiabank to inquire about transferring your accounts. Many banks can assist with moving your accounts over, and you may be able to take advantage of more competitive offers.

Did you know?

Rising Delinquency Rates ❎ The delinquency rate among consumers aged 26 to 35 has increased by more than 18% compared to the previous year, indicating a growing number of missed credit payments in this age group.

High Average Credit Card Balances 🔼 As of the third quarter of 2023, the average credit card balance for Canadians was $4,265, with younger consumers disproportionately affected.

Increased Reliance on Credit 💳️ Approximately 43% of Canadians currently have credit card debt, with young adults being particularly impacted by rising interest rates and the escalating cost of living.

1,000 Hours of Excel

When I was a kid, I thought banks were just the nice people who kept our money safe from the "bad guys." Over time, I realized the truth: banks aren’t in it just to protect your cash—they’re in it to make money off you. Every time you swipe your card or take out a loan, someone’s making a profit.

Now, let’s talk about how banks see us, the future doctors. We're considered high earners, which makes us a prime target for banks. They love us because we’re likely to take out big loans—think mortgages, lines of credit, and credit cards. The kicker? Banks make their money by charging high interest rates, often upwards of 20%, while luring us in with low or zero-interest offers at the start. The longer we carry debt, the more they make.

So, where do banks get all this money to hand out? From us! They take the cash we deposit and lend it out to others, making interest on that too. The government even regulates how much they can loan out, so they don’t run out of cash during a big withdrawal rush.

Here’s the key takeaway: We’re worth a lot to the banks. We’ll probably end up with bigger mortgages than most, and those interest payments are a gold mine for them. But if we’re not careful, that same system can turn against us—especially when it comes to credit card debt, which can eat away at our wealth. Student lines of credit? You're paying for the privilege of borrowing money, and that interest just gets added to your balance.

Bottom line: Understand the game you’re playing. Make sure the bank is giving you what you deserve in return for your business. If they’re not, don’t be afraid to take your money elsewhere.

Until next Saturday…

Christian, Founder of Budget Your MD

P.S. Loved this? There’s plenty more where that came from… Head over to budgetyourmd.ca for all the juicy tips you didn’t know you needed. But hey, if this wasn’t your cup of tea, feel free to hit unsubscribe (we’ll miss you, though)!

Let us buy you something 🎁

You can get free stuff for telling your colleagues about Budget Your MD 👇️

60 Referrals - New FIGS scrubs 🩺

20 Referrals - $40 Lululemon Gift Card 👟

5 Referrals - $10 Starbucks Gift Card ☕️

Copy & paste this link 👉️ https://budgetyourmd.beehiiv.com/subscribe?ref=PLACEHOLDER_CODE

Want more of this content directly to your inbox? 📩 Enter your email below and join the community 👇