Analysis of BC Line of Credit Offers for Medical Students

I picked Scotiabank when entering medical school in 2020. Many factors contributed to me choosing this bank. First, it is important to analyze the earning potential of each of the credit cards they offer. For example, being rewarded 5 points on groceries/dining/subscriptions is the best of all credit cards offered for each bank. Given this card is an American Express, not all stores will accept it. Therefore, Scotiabank will allow you to sign up for both cards (AMEX and VISA) to give you another option in those situations. Second, from my knowledge, Scotiabank is the only bank to allow you to have multiple credit cards, providing double to opportunity for reward points. Lastly, in 2019, MD Management (a financial advisory firm specifically for doctors) merged with Scotiabank. From my perspective, this shows Scotiabank’s commitment to working with physicians and providing the best deal possible.

When you see a “Welcome Bonus” associated with a chequing account offer. Know that this will only apply to you if you’re moving to this bank for the first time. If you’re previously banking with them, it is extremely unlikely that they will give you this additional gift when opening up this new account for medical school.

Once again, RBC offers a extremely competitive medical student offer. In general, RBC is intent on their goal of having students bank with them throughout university. Thus, it would only make sense they offer good benefits for future medical professionals.

A few unique parts of their offer is the Petro-Canada partnership, providing students with an opportunity for slightly cheaper gas. But I was surprised that when you truly do the math (using Canadian averages), that saving 3 cents per litre doesn’t do much in terms of savings in the long haul. In addition, a free iPad is intriguing, but remember that Apple Canada regularly offers discounts to students which makes this less valuable than other offers. (student deals begin late summer/early fall).

Also, it’s important to note that I’ve heard RBC will only allow you to chose 1 credit card. Therefore, you’d be left choosing between the Avion Visa Platinum and the WestJet Mastercard. Each have their pro's/con’s but one I’d consider is if you’ll actually end up flying once a year and using that companion voucher. Medical school is busy, and if you don’t use the voucher within a year, it will expire.

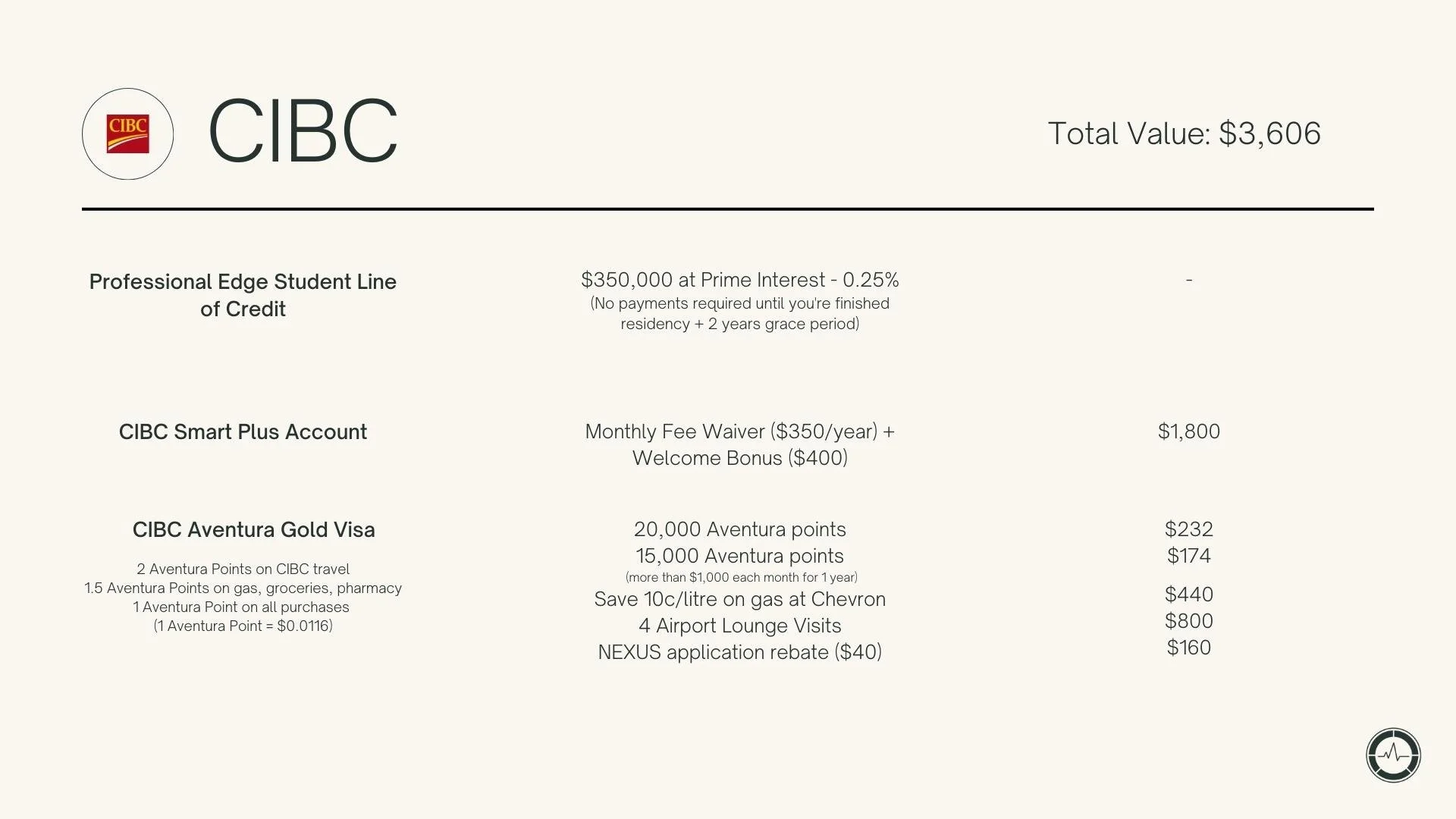

CIBC has a very competitive plan when it comes to their medical student offer. Very similarly to most plans, a $350,000 LOC is included and a premium credit card is waived for the 4 years of medical school.

What makes CIBC fall slightly behind in the true analysis of their offer is the credit card option. Although they offer decent welcome bonuses, the ability to accumulate points day-to-day is limited by their poor categorical bonuses for shopping for groceries, gas, etc. You may remember Scotiabank’s AMEX will give 5 points for groceries, while here you would only receive 1.5 points per dollar spent.

This is a point that can be made for all banks aside from Scotiabank, but the offer being limited to only one credit card instantly makes the earning potential for “welcome bonuses” less in this case.

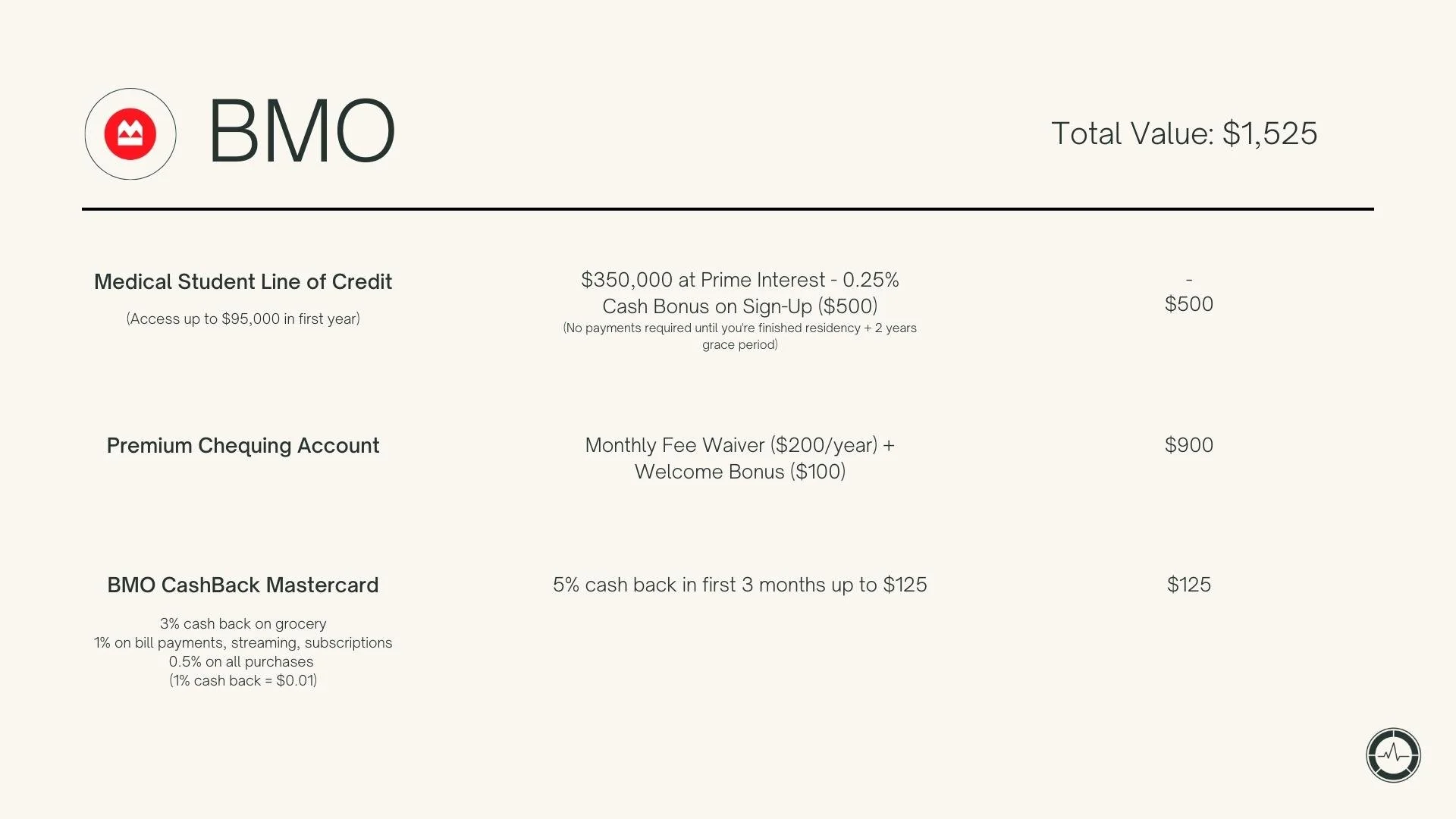

The last 2 banks, from my perspective, lack the potential benefits of Scotiabank, CIBC, and RBC. It may just be that these banks are less orientated towards signing up medical students, and have other focuses.

If there is one reason to use TD, it would be the ability to earn 5 points on travel with the Platinum Travel Visa. For the most part, travelling during medical school is quite limited, but I can't speak for everyone. It also provides 3 points per dollar on groceries which is quite reasonable. If I was banking with TD I’d use the opportunity to be a new customer at either Scotiabank, CIBC or RBC and get some of their welcome bonuses from moving banks. Lastly, TD also will not allow you to have 2 credit cards, I’ve highlighted the two options above, but you’d have to make the choice of which one suits your lifestyle best.

Immediately, you can see the low "total value" of this deal with BMO. When analyzing the offer, it appeared to me the largest downfall was their CashBack Mastercard. This credit card has no annual fee, regardless of your enrolment in medical school, therefore lacking the uniqueness of previous offers. For the most part, an annual fee of a credit card will coincide with the amount of benefits it provides.

If you are currently banking with BMO and you feel stuck, I would suggest contacting RBC. In a recent phone call with one of their advisors, I was told they have the ability to effectively move accounts over from competing banks. I’m sure CIBC and Scotiabank would be more than happy to help you as well.

It’s also important to point out the limited access to your complete LOC in the first year. Only $95,000 can be used during your first year. This is most likely one of their protective techniques so students don’t go buy homes or invest in stocks with their line of credit, putting them at risk fo defaulting on their payments.